Retroactive Tax Credits 2024 California Income

Retroactive Tax Credits 2024 California Income – So, while a tax increase is true for most people making more than $154,000, the potential combined tax rate of 14.4% applies to California’s top income tax bracket, meaning people earning more than $1 . Here’s how a proposed change in the rules for the child tax credit impact tax refunds and the upcoming tax season. .

Retroactive Tax Credits 2024 California Income

Source : www.voltequity.com

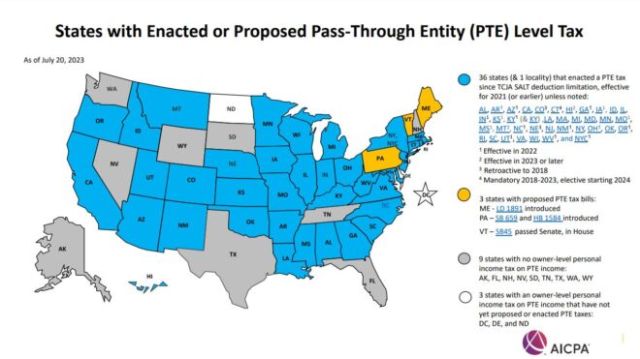

Did you know 36 states have enacted PTE tax laws to enable owners

Source : www.tafttaxinsights.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

https://.nysscpa.org/cpaj images/CPA.2023.93.3.

Source : www.cpajournal.com

Retroactive Filing for Employee Retention Tax Credit Is Ongoing

Source : www.shrm.org

Did You Know 36 States Have Enacted PTE Tax Laws To Enable Owners

Source : www.mondaq.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Clean Energy Business Network | Washington D.C. DC

Source : www.facebook.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

The Tax Relief for American Families and Workers Act of 2024

Source : www.wolterskluwer.com

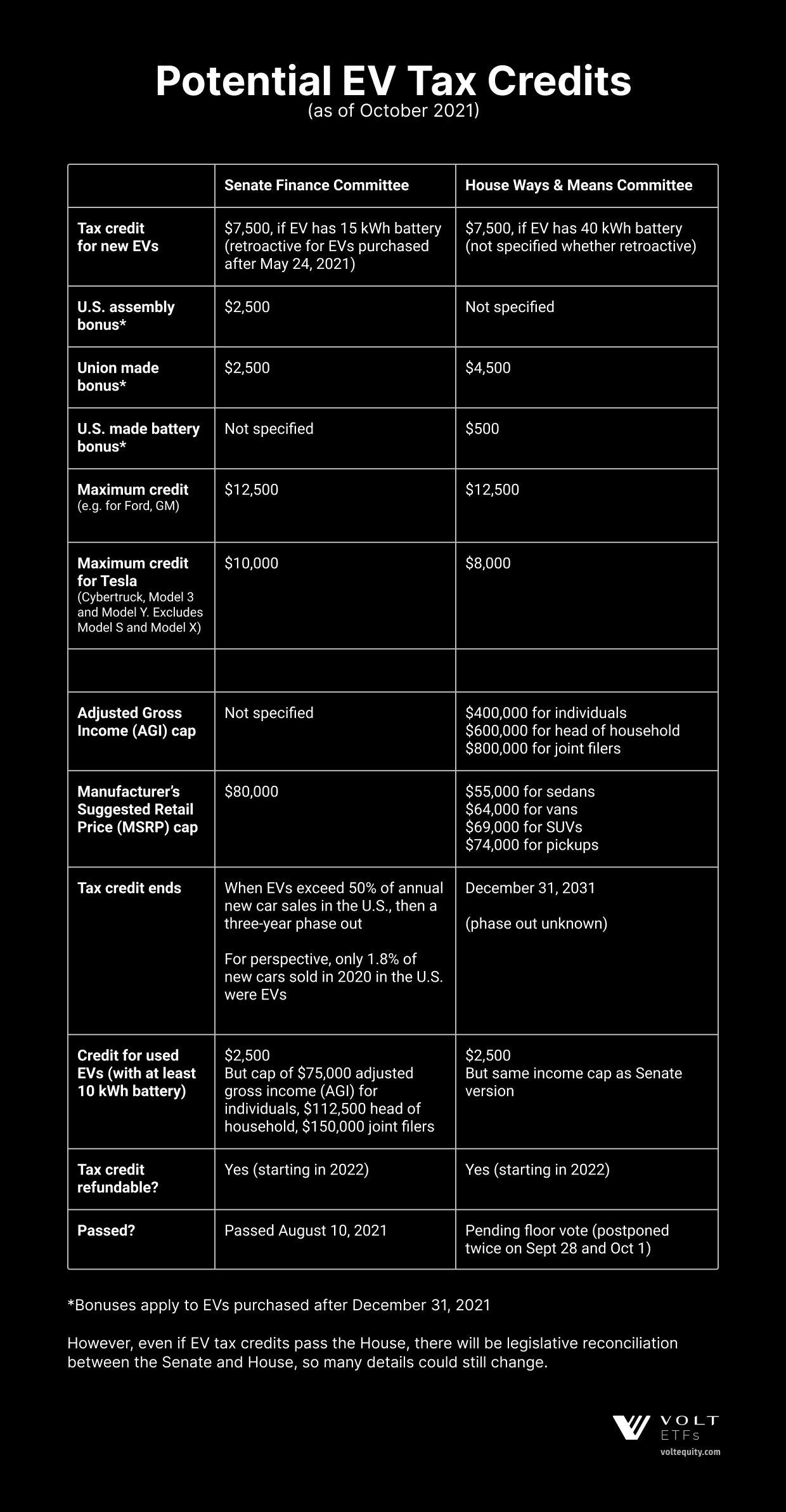

Retroactive Tax Credits 2024 California Income The Tesla EV Tax Credit: The plan temporarily expands access to the child tax credit with retroactive $1,900 for 2024 and $2,000 for 2025 — and a new calculation would expand access. The current calculation for the . You may be eligible for a child tax credit payment — in addition to the federal amount — if you live in one of these states. .